This article will explain what payday loans are, how they operate and why their payday loan centres are not in your best interests. Here’s a brief overview of payday loans and the centers that support them. How do lenders calculate them? How they do not serve your best interest. Learn more about payday loans. Also, we will explain how to tell the difference between a Credit Card Loan and a Loan from a Bank or Credit Union. We will explain how to get a payday advance and find the right one for you.

How do payday loans work?

Loan credits and other consumer debt play a major role. It is possible to get a digitally paid loan or from a virtual branch of a financial institution. Payment loans are regulated by different laws in multiple states. These laws limit the amount of money you can borrow or the extent to which the creditor may demand interest. Most countries have banned payday loans. Once you have been approved for a payday loan, you can withdraw money from your debit card or collect a receipt. You should repay the entire mortgage along with the economic costs, typically in three weeks or at the time of the first payment.

The Payday Loan Process

Payday loans work the same way in most cases. Borrowers must repay a high-cost, short-term loan when they get their next paycheck. These loans can be in the form of deferred deposits, cheques, or a passage, which is a verified loan. Payday loan recipients often renew them in states that allow it. Even though they cannot afford to repay the loan, people renew payday loans in states where it is allowed. The short-term cost or high interest rate of the loan is usually paid back after a few months of repayment.

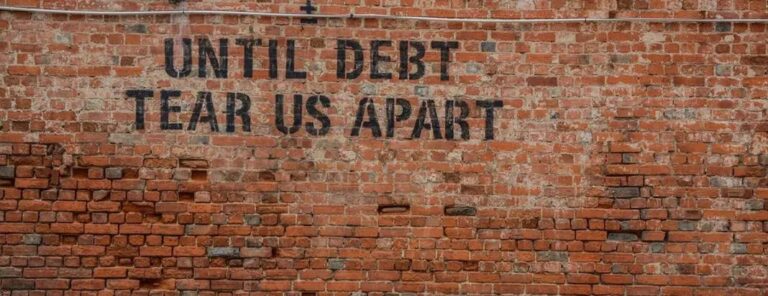

Why are payday loans bad?

Payday credit will help you through the loan process. You may feel that you are stuck because of an unfortunate event. You think that you’ll have bad loans, and therefore no reserves. Selecting a payday loan can have a negative impact on your debt. You can use any savings you have, or even go to court if you don’t.

The Trap

Deferral is a term used by lenders to describe extending a payday loan if you have trouble repaying it. Credit can have a negative side effect. Financial Conduct Authority: The payday loan trap can be avoided if you refuse to accept it.

Payback

You can access your payday loan if you give the lender permission for them to garnishee your wages. It is almost impossible to get out of this situation. If you are unable to repay your payday loan, the lenders will be brutal in collecting.

Payday loans are not personal loans

Borrowers might need additional money to pay for their monthly expenses. They are also unable to pay back a loan in time and become increasingly indebted. Some lenders refuse to lend money to those who have taken payday loans. These loans, which are usually made directly to lenders and not to borrowers, aren’t quick solutions. The same applies even if a borrower withdraws several paychecks within a year. Payday loans are a way to circumvent the laws by acting as intermediaries between lenders and their customers. A payday loan is different from a ” Personal Loan”, in that it’s not a loan provided by a credit card or bank.

The Last Chance

Payday loans can be expensive, and they can worsen your situation if you cannot afford to pay them back on time. This type of loan is only a viable option if there are no other options. A payday loan will not only delay an inevitable financial disaster, but also help you avoid one. You should explore all other options before you consider a payday loan. Most loans will cost less than one.

+ There are no comments

Add yours