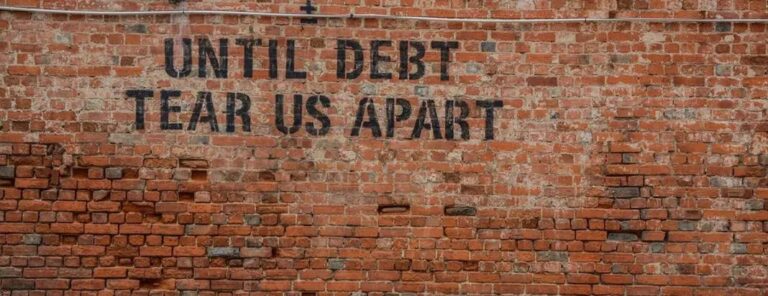

A lender or mortgage servicer may allow a borrower to temporarily make Mortgage payments, either by stopping the payment process or by reducing payment. Forbearance is the name of this procedure. Forbearance gives you the chance to cope with tough times. You might be able to get a loan if you’ve had an illness or injury that has increased your medical expenses, or if you lost your job or your home due to flooding.

You still have to make up any missed or reduced payments on your mortgage.

Loan Forbearance

What is a Loan Forbearance?

This is a temporary way to lower or stop your loan repayments. This is not a strategy to delay repayments indefinitely or for a long time.

According to US Department of Education, approximately 2.7 million federal student loan borrowers were in Forbearance for their loans in 2019.

Consider Loan Forbearance as a very last resort in order to avoid student loan default.

What are the exceptions to using a forbearance?

You can only use loan forgiveness if:

- You do not expect to have to wait a long period of time before you can proceed with the repayment.

- Your loan is not repayable due to a severe financial crisis.

How long can a student loan be forbeared?

The Student Loan forbearance allows you to temporarily reduce or pause your monthly payments as a borrower of student loans.

The federal loan can be forbeared up to 12 months. There is no maximum period. As a borrower of federal student loans, you can request forbearance from the lender as many times you like. In most cases, however, the servicer will limit the amount of Forbearance you can receive.

+ There are no comments

Add yours